In the Age of Scale, Italy’s Independent Fashion Houses Face a Crossroads

As global fashion consolidates around scale and visibility, Italy’s independent luxury houses face mounting pressure to evolve while still holding onto their heritage

Craft over corporations

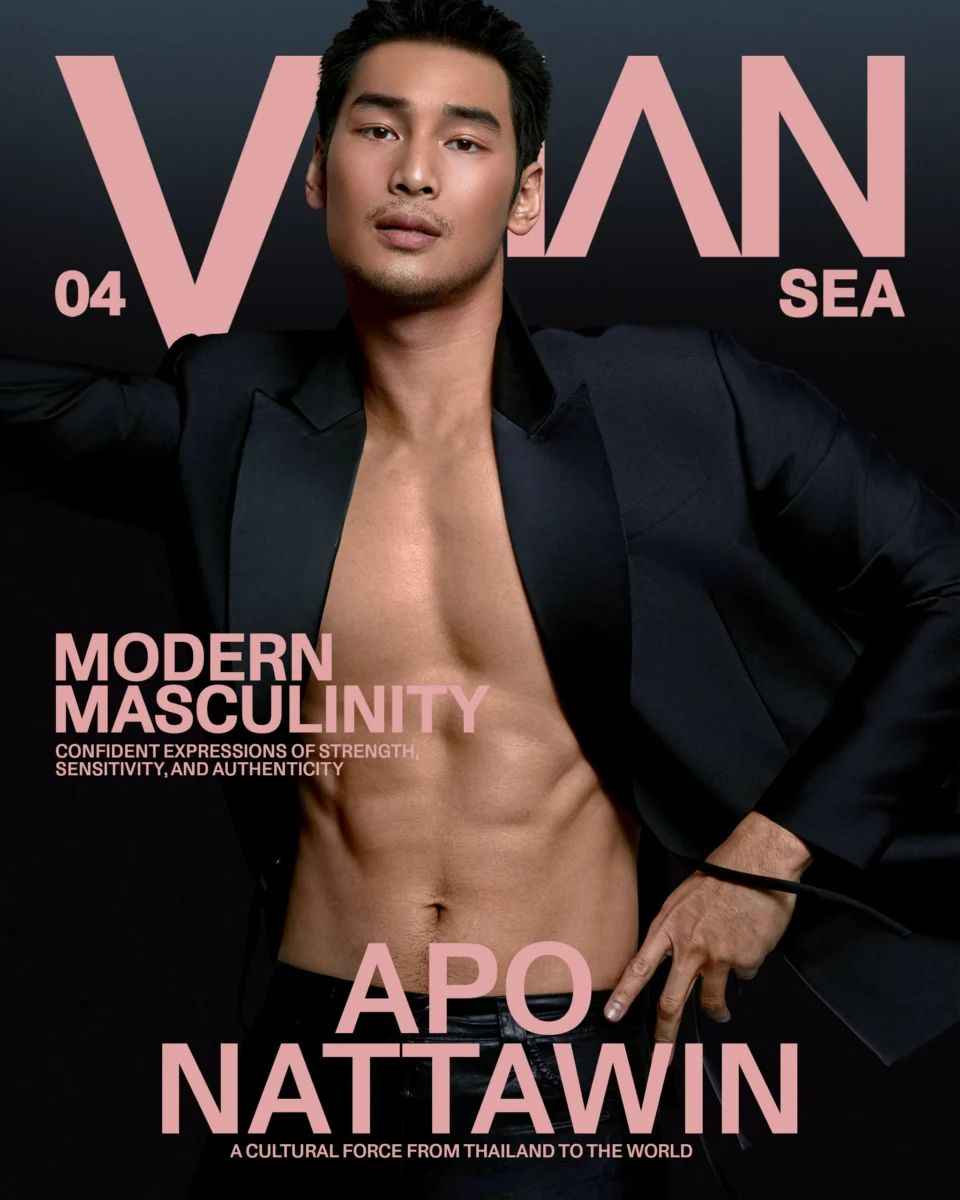

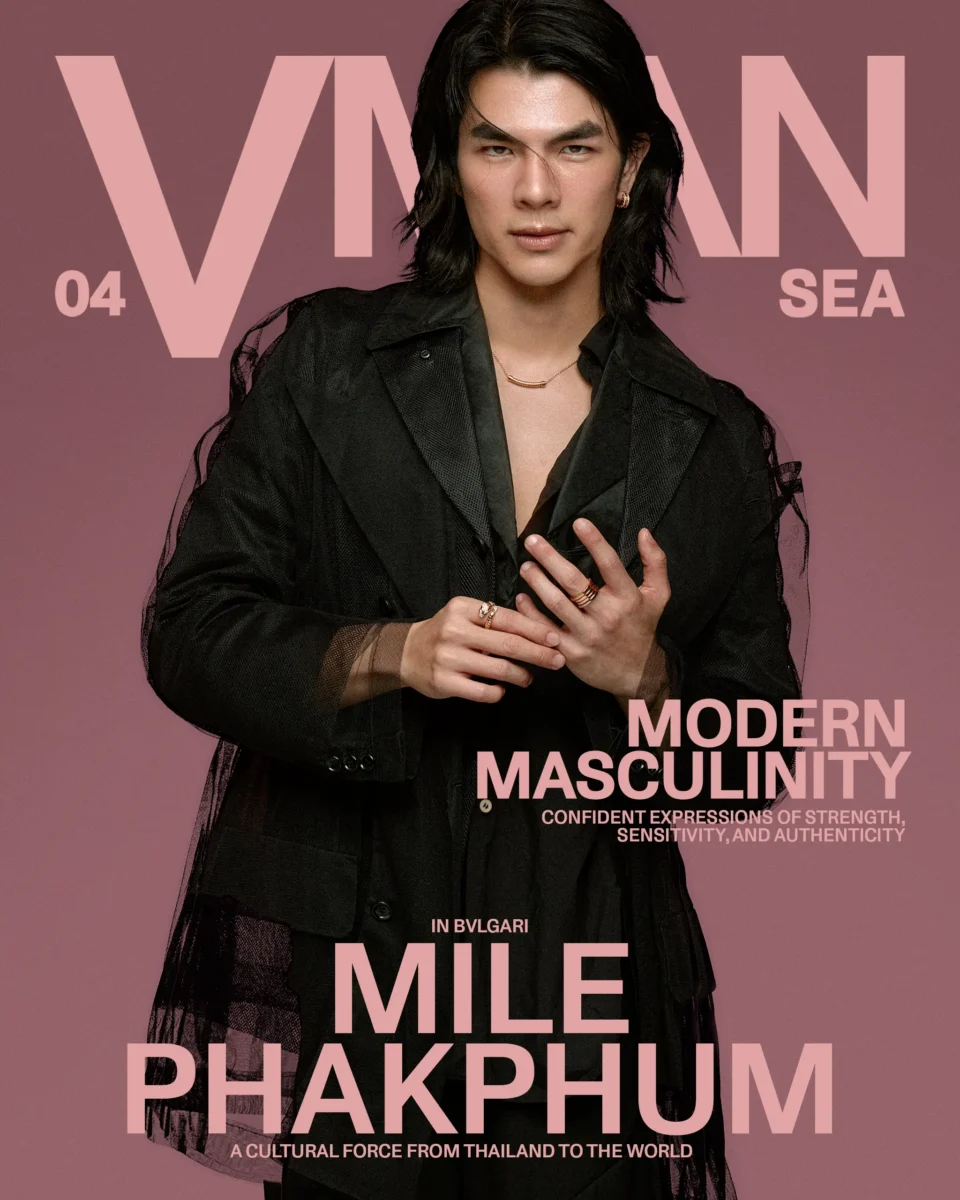

In the southern reaches of Italy, far from the corporate headquarters of Milan or Paris, luxury still moves at a human pace. Brands like Kiton, ISAIA, Lardini, and Barba Napoli continue to operate as family-run enterprises. These are names that may not command the same global recognition as Prada or Gucci, but their legacy lives in the hands of artisans, in the feel of cashmere, and in the drape of a jacket shaped to the customer rather than the algorithm.

ALSO READ: The Best Luxury Tie Brands Right Now for Every Occasion

Italy’s luxury industry has long been defined by this tension. Many of its most storied labels began as modest workshops. Ermenegildo Zegna, for instance, was founded in 1910 by Michelangelo Zegna, a watchmaker by trade, who established a textile mill in the town of Trivero.

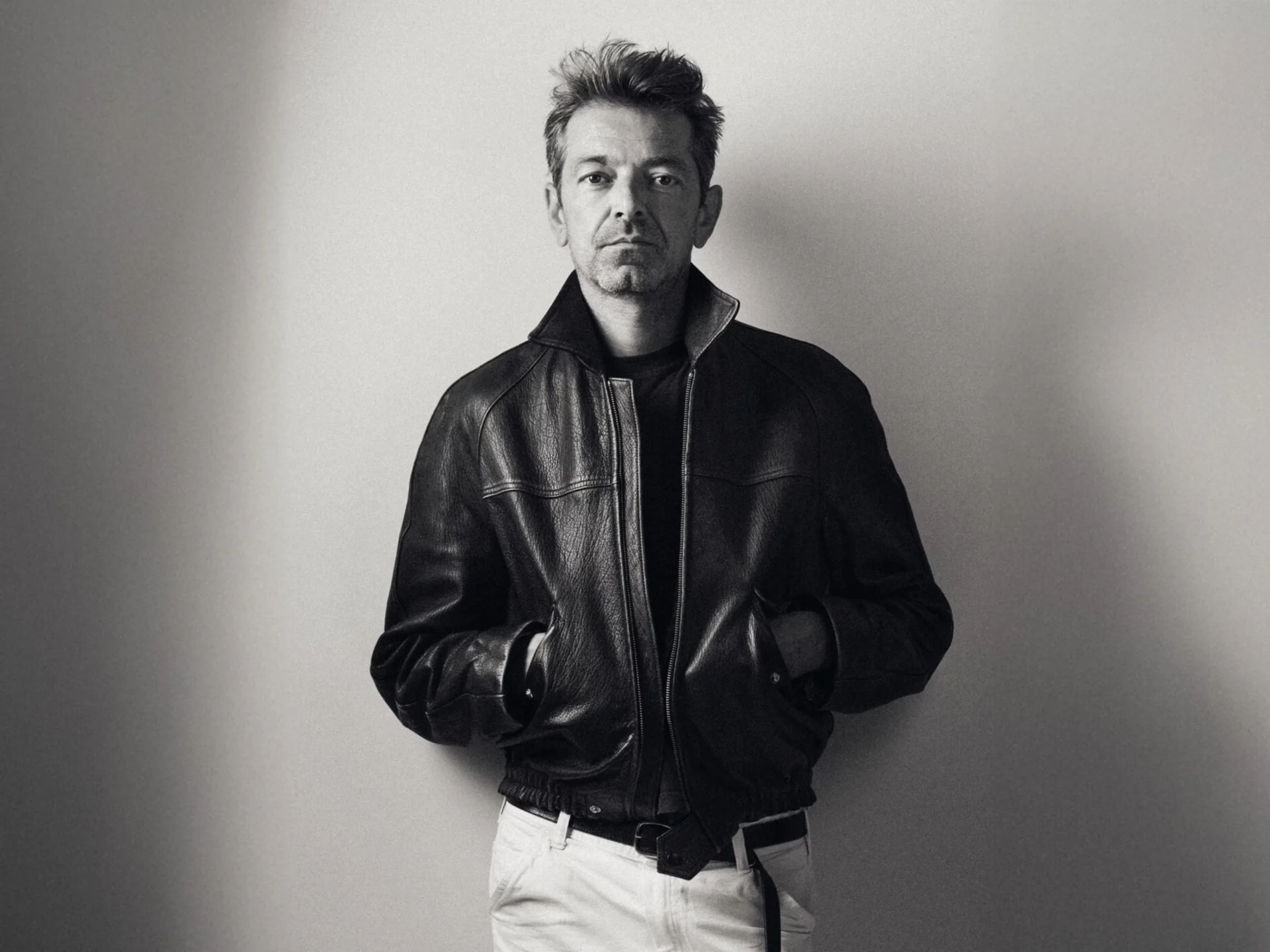

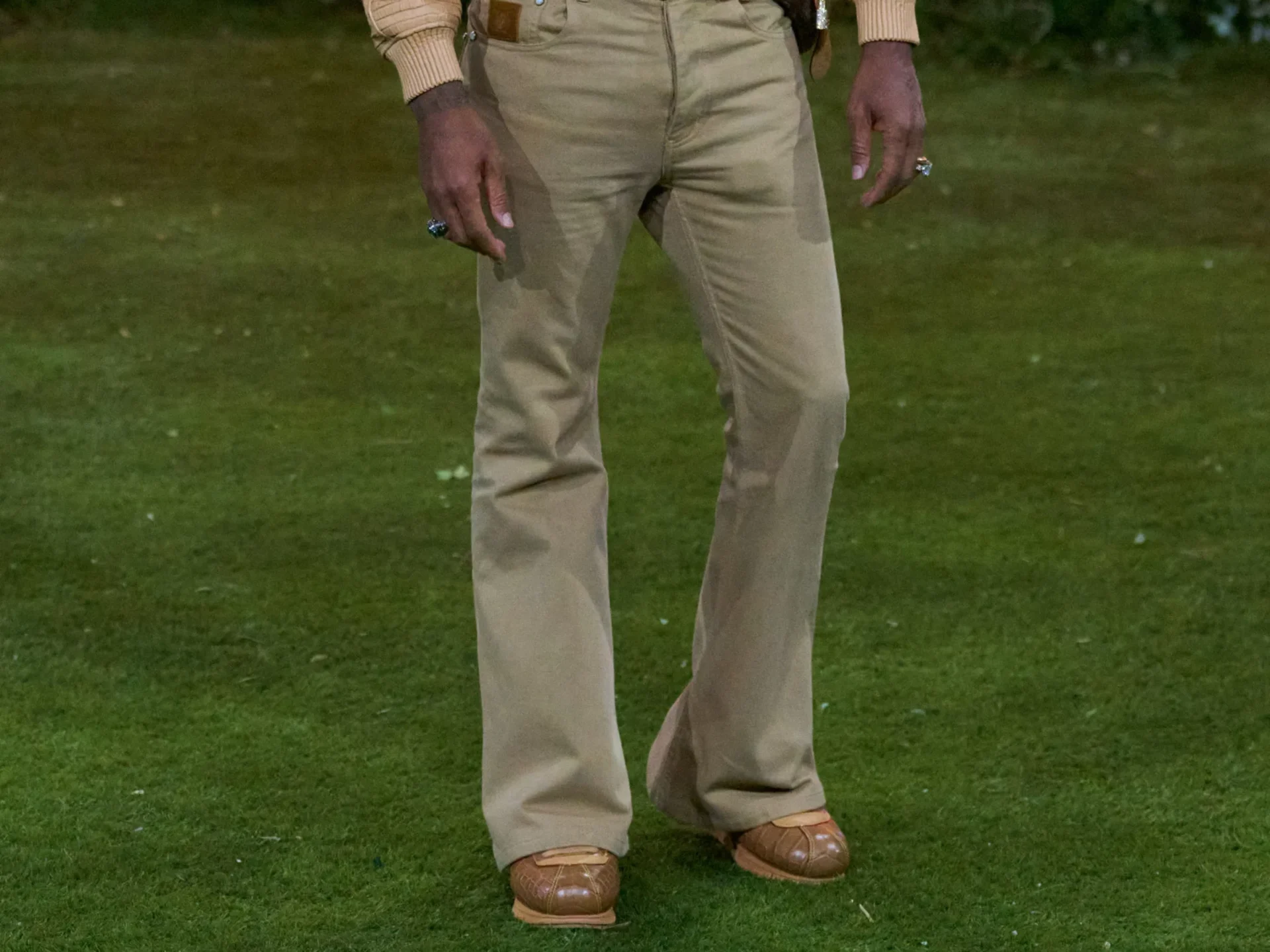

Renzo Rosso, now head of the OTB Group, dropped out of university and began his career managing trouser production at a local factory. Even Antonio Paone of Kiton built his knowledge client by client, fabric by fabric, following the old Neapolitan way.

That foundational closeness to craft is what has long set Italian fashion apart. Unlike the high-volume, high-gloss model popularized elsewhere, Italy’s strength has traditionally come from its deeply rooted network of family firms.

These are companies where tailoring, dyeing, weaving, and cutting were often passed down like heirlooms. This intimacy has shaped an ecosystem that is decentralized, yet connected, and artisanal, yet commercially viable.

But the landscape is changing.

Adapting to a shifting landscape

As global competition accelerates and the fashion industry becomes more capital-intensive, even some of the most traditional Italian brands are adapting to new realities. Many have sought investment or formed alliances to strengthen their position.

L Catterton, a private equity firm backed by LVMH, now owns a 70 percent stake in Etro. FSI has invested in Missoni. Meanwhile, Zegna and Prada jointly acquired a minority stake in Fedeli 1934, a knitwear specialist known for its excellence.

Rather than signaling decline, these moves reflect a broader recalibration. The Italian fashion sector is recognizing that staying competitive may require new models of cooperation, investment, and growth.

For some, that means ceding partial ownership in exchange for greater reach and access to global markets. For others, it may mean doubling down on niche appeal, authenticity, and generational know-how.

What remains consistent is the value of heritage. In an era increasingly dominated by brand saturation, the subtlety of Italian craftsmanship has found renewed appreciation, especially among consumers seeking quality over quantity. And while global luxury groups have the muscle to scale quickly, they often look to Italy’s smaller producers for credibility and depth.

The case for collaboration

At the same time, there is growing conversation within the industry about collaboration. While Italy’s independent houses have often operated in silos, many observers now suggest that shared resources, marketing platforms, and production capabilities could offer mutual benefits. These partnerships do not have to compromise identity; instead, they could help ensure its survival in a global market that increasingly rewards visibility.

The distinction between north and south also continues to evolve. While northern brands have historically been more assertive in their international presence, southern houses from Naples to Puglia have remained committed to local and meticulous craftsmanship. As global attention shifts toward authenticity and origin, this regional strength may yet become a strategic advantage.

Ultimately, Italy’s independent luxury houses are not fading relics of a bygone era. They are living, working examples of how tradition can coexist with innovation. Their next chapter will likely be shaped by a combination of pragmatism and pride, strategy and soul.

The question is not whether they will change, but how, and on whose terms.

Photos courtesy Kiton, ISAIA, Lardini, Barba Napoli, Zegna